jersey city property tax delay

The median property tax in New Jersey is 657900 per year for a home worth the median value of 34830000. Didnt realize a city had the right to delay it.

Reexamining Residency Requirements For Police Officers Fivethirtyeight

There is a lot to know when it comes to owning a home and.

. New Jerseys real property tax is an ad valorem tax or a tax according to value. In Jersey City the average residential school tax in 2021 was. City of Jersey City.

The city is appealing the ruling in the breach of contract lawsuit regarding the 2010 revaluation attempt. Jersey City taxpayers would normally be granted a 10-day grace period to pay their tax bill meaning you could pay your taxes until August 10 th if it was issued on August 1 st without being hit with interest charges for the late payment. Property taxes are the major source of funds for Jersey City and the rest of local governmental entities.

Provide Tax Relief To Individuals and Families Through Convenient Referrals. The standard measure of property value is true value or market value that is what a willing. City of Jersey City - Delayed Tax Bills The 2017 final tax bill has not yet been mailed.

280 Grove St Rm 101. Besides counties and districts such as hospitals numerous special districts like water and sewer treatment plants as well as parks and recreation facilities depend on tax money. Free Case Review Begin Online.

The administration did not issue estimated tax bills in 2021 as what has been done in the past. Ad See If You Qualify For IRS Fresh Start Program. 189 of home value.

A property tax reward program would provide monetary rewards to participating customers who purchase goods or services from participating businesses. Jersey City is a municipality inHudson County and each of the municipalities here deals with taxes differently. For specific language of the enacting legislation please see L.

Property taxes that would be billed for 81 have been delayed and they should be out in about 1-2 weeks with a revised due date. Due to changes made by the State of New Jersey to the awarding of State Aid to the school districts. New Jersey has one of the highest average property tax rates.

I did get an email from Jersey City OEM about it. Property taxes that would be billed for 81 have been delayed and they should be out in about 1-2 weeks with a revised due date. The average tax rate in Jersey City New Jersey a municipality in Hudson County is 167 and residents can expect to pay 6426 on average per year in property taxes.

Account Number Block Lot Qualifier Property Location 18 14502 00011 20 HUDSON ST. Across the state the average homeowner pays 4908 a year in school taxes roughly half of the average property tax bill of 9284. Property Taxes are delayed.

Nothing is due today. City of Jersey City - Delayed Tax Bills The 2017 final tax bill has not yet been mailed. All real property is assessed according to the same standard of value except for qualified agricultural or horticultural land.

In Jersey City the average residential school tax in 2021 was. It is expected that taxes will increase for one-third of the citys property decrease for another third and. Monday August 7 2017 103802 AM EDT Subject.

The program would be operated by a private entity designated by the municipality. General Property Tax Information. Online Inquiry Payment.

Assemblyman Robert Karabinchak D-Middlesex filed a bill Thursday to delay the May 1 due date to July 15 when state and federal tax returns are now due for commercial and residential properties. New property values will affect taxes in 2018. Legal costs for Jersey City have totaled at least 325000 as of February 2016.

Counties in New Jersey collect an average of 189 of a propertys assesed fair market value as property tax per year. Tax amount varies by county. I thought NJ required billing to be done on time per law.

Jersey City New Jersey Property Tax Revaluation 2016 Ballotpedia

Jersey City Public Schools Funding Civic Parent

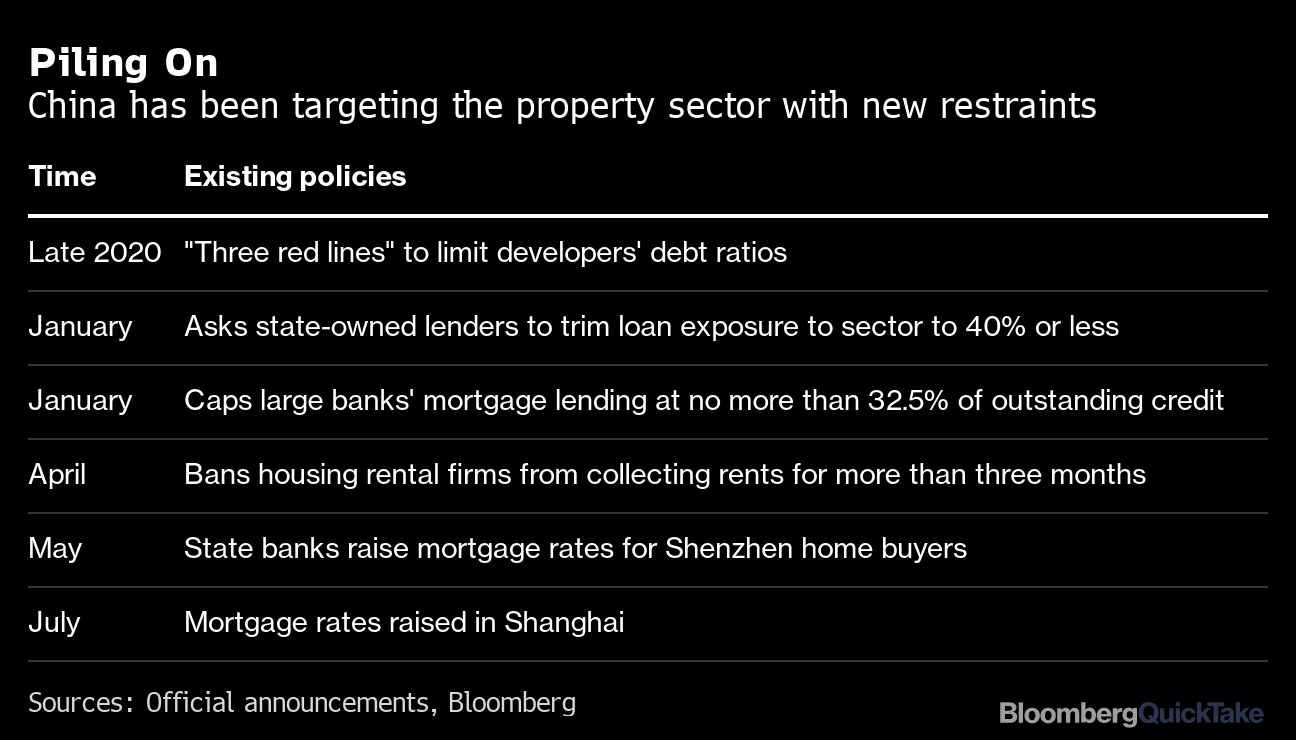

Why China Could Be Serious About A Property Tax Now Quicktake Bloomberg

City Of Jersey City Online Payment System

Chapter 345 Zoning Code Of Ordinances Jersey City Nj Municode Library

Chapter 345 Zoning Code Of Ordinances Jersey City Nj Municode Library

Jersey City Public Schools Funding Civic Parent

How The Mayor Stuck Wards A B C And D With 143 Million In Taxes

Jersey City Public Schools Funding Civic Parent

Chapter 345 Zoning Code Of Ordinances Jersey City Nj Municode Library

Property Taxes Haldimand County

Jersey City Public Schools Funding Civic Parent

Tax Assessor Fort Lee Borough Nj

Coronavirus Jersey City Cases Updates And More May 2022 Jersey City Upfront

Chapter 345 Zoning Code Of Ordinances Jersey City Nj Municode Library